Out With The Old, Enter Self Storage: Adaptive Reuse Skyrocketed Last Decade And Is Now Accelerating In The Sunbelt And Northeast

- Adaptive reuse in self storage accounts for roughly 179 million

square feet of space across the U.S. in completed supply, around 10% of

the country’s total inventory.

- Over half of the existing inventory was delivered in the past decade – that’s almost 108M square feet of self storage space.

- Close to 3.8 million square feet of converted self storage space

is under construction nationwide, accounting for 7.2% of all upcoming

development.

- The East Coast and Midwest have the most cities working on self

storage conversions, yet the Sunbelt stands out – Irving, TX, has more

adaptive reuse space under construction than any other city. The city is

set to add about 233,000 square feet of conversion projects.

- In 32 cities, every facility currently being built is a

conversion project — totaling 2.3 million square feet or about 60% of

all adaptive reuse space now in development.

- Following efforts to support urban revitalization, 20% of storage conversion projects currently built are located in federally designated opportunity zones.

...Full Story Here

RSK: A good amount of self storage is coming from the old Midwest cities that have Industrial, Retail or office to do adaptive reuse into self storage.

New Tax Law Makes Opportunity Zones Permanent, Helping Advisors Find Tax Breaks for Clients

Among the many provisions in the massive One Big Beautiful Bill Act passed into law this month is the permanent extension of the Opportunity Zone program, along with some tweaks to how they work. Making the program permanent and allowing investors to participate on a five-year rolling basis should make it more attractive for financial advisors looking for tax breaks for their clients, since they will no longer have to worry about an upcoming sunset date. However, in the short term, the timing of the rollout of the updates will likely mean lower demand for OZ investments, industry insiders say...

...Full Story Here

RSK: Some good news however, a lot of questions remain on implementation etc. Stay tuned on this one.

The One Big Beautiful Bill: Initial Analysis of Key Provisions for the Real Estate Industry

On May 22, 2025, the House of Representatives passed H.R. 1, the budget reconciliation bill known as the One Big Beautiful Bill Act (the Tax Bill). The Tax Bill proposes amendments to the Internal Revenue Code (the Code) that could have significant consequences for both individuals and businesses. Below is a summary of the key changes under the Tax Bill that would impact the real estate industry and real estate funds.

The Tax Bill has now moved to the Senate for consideration, where further modifications to the tax provisions discussed below may be made. We will continue to provide updates as the bill advances through the legislative process in Congress.

I. Qualified Business Income Deduction (Code Section 199A)...

II. Deduction for Qualified Production Property...

III. Bonus Depreciation...

IV. Increased Limitation for Expensing Certain Depreciable Assets...

V. Excess Business Losses Limitation Extended...

VI. New Round of Qualified Opportunity Zones...

VII. Low-Income Housing Credit...

VIII. Revisions to REIT Asset Test...

IX. Increased Taxes, Including Withholding Obligations by Real Estate Funds, on Income Allocated to Foreign Investors From Certain Countries...

RSK: Worth reading....new deductions in depreciation for production and development properties among others.

Ken Notes: Share this article with others it is very well done...

Opportunity Zone Industry Gearing Up For Expansion Under Trump

The opportunity zone program — the tax break for businesses investing in economically distressed communities — was a key pillar of the Trump administration’s economic policy the first time around.

The opportunity zone program — the tax break for businesses investing in economically distressed communities — was a key pillar of the Trump administration’s economic policy the first time around.Passed with the Trump tax law in late 2017, the program has fueled tens of billions of dollars of investment. The pace of funding has slowed as the program sunsets at the end of 2026, meaning investors are nearing a deadline to deploy funds into one of the nation`s 8,764 qualified opportunity zones.

RSK: Hope the new administration outlines a few more or expands the Zones. I know a few people who have to invest or pay their capital gains...including myself.

9 Things For Commercial Real Estate To Watch In Trump`s First 100 Days

Homebuilding regulations could be loosened, but mass deportations could make it harder to find construction labor to build new homes. Questions swirl around what kind of tariffs Trump plans to impose and what they would mean for inflation. Battle lines are already being drawn over remote work for federal employees, while Fannie Mae and Freddie Mac are on the path toward privatization.

Here’s a look at what nine early policy decisions could mean for commercial real estate.

- Renewed Opportunity Zones

- Mass Deportations

- The Fight Over Remote Work

- The 2 Sides Of Tariffs

- The Future Of Fannie Mae And Freddie Mac

- Cutting Affordable Housing Red Tape

- Development Fast Tracks

- Cryptocurrency Regulation

- Dealmaker In Chief

RSK: Not sure how mass deportation will effect CRE but others seem like they could happen. Interesting read.

How Will Trump`s Win Impact Rental Housing? Eight Issues to Watch.

And reviewing the results of rent control ballot measures across the country.

Housing became a central issue on the campaign trail this year. Now that former President Trump has become President-Elect Trump, what could be the impact to rental housing providers and renters? Here are eight issues to watch below.

Plus: We’ll review the results of rent control ballot measures across the country — headlined by California voters overwhelmingly rejecting Prop 33’s attempt to expand rent control across the state.

...Full Story Here#1: Less Likely to See Tax Penalties Pushed on SFR Investors

#2: Less Likely to See Expansion of LIHTC

#3: Building Housing on Federal Lands

#4: Bipartisan Push to Remove Regulatory Roadblocks to Housing

#5: Tariffs and Immigration Policy Could Push Up Construction Costs

#6: Potential Extension of Opportunity Zones

#7: What Will Trump Do with Fannie and Freddie?

#8: Apartment Supply Will Almost Certainly Decline (Regardless Who Won)

RSK: I`m not sure there will be much of an effect in our market area. Expanding opportunity zones will need a lot of tweaking. It wasn`t really a hit the first time around but with some adjustments it may be better this time around...especially if they expand the zones.

Investment In Opportunity Zone Projects Has Plunged As Program Approaches Its End

Equity investment in opportunity zones has plummeted by nearly 70% this year as economic strain and uncertain tax breaks hold investors back despite the program’s approaching sunset in 2026.

Equity investment in opportunity zones has plummeted by nearly 70% this year as economic strain and uncertain tax breaks hold investors back despite the program’s approaching sunset in 2026.A potential extension of the program under the next president has been pitched, but investors in the space say anyone who wants to take advantage of the program should do so as soon as possible.

“Anyone who wants to start a[n Opportunity Zone] project better start it,” StarPoint Properties CEO Paul Daneshrad told Bisnow. “I wouldn’t be investing into an OZ project in 2026 with the chance that it wouldn’t be grandfathered in.” ...

...Full Story Here

RSK: Not sure why OZ`s never really took off but possibly if more CRE agents had the properties listed they would have promoted them more as they do with other properties. Never underestimate the power of CRE Agents and their marketing.

OPPORTUNITY ZONE HOME PRICES CONTINUE RIDING WAVE OF GAINS ACROSS U.S. DURING SECOND QUARTER OF 2024

Median Home Values Increase in More Than Half of Opportunity Zones Targeted for Economic Redevelopment; Price Trends Inside Those Zones Continue to Closely Follow National Market Patterns; Some Measures in Opportunity Zones Again Outpace Nationwide Improvements

IRVINE, Calif., Aug. 8, 2024 /PRNewswire/ -- ATTOM, a leading curator of land, property, and real estate data, today released its second-quarter 2024 report analyzing qualified low-income Opportunity Zones targeted by Congress for economic redevelopment in the Tax Cuts and Jobs Act of 2017 (see full methodology below). In this report, ATTOM looked at 3,904 zones around the United States with sufficient data to analyze, meaning they had at least five home sales in the second quarter of 2024.

The report found that median single-family home and condo prices increased from the first quarter of 2024 to the second quarter of 2024 in 61 percent of Opportunity Zones around the country with enough data to measure. They were up annually in 62 percent of the zones analyzed.

RSK: Opportunity Zones or OZ`s are still a worthy investment. Here is a list of where the zones are in Madison, WI.

Six Years of Opportunity Zone Progress and Controversy

- Despite

billions invested and some success stories like downtown Erie, PA, the

program faces criticism for potentially favoring already improving

areas.

- Proposed reforms, focusing on enhanced oversight, aim to boost the program`s effectiveness and ensure fairer outcomes in community redevelopment.

RSK Opportunity Zones are working their tax advantages for investors...but not for what they were meant to be....a boost to help low income areas pull up by their bootstraps.

Six Years of Opportunity Zone Progress and Controversy

The tax incentive established in 2017, aimed at boosting economic growth and investment in struggling communities, has yielded mixed results. While the program has achieved some successes, it has also faced increasing scrutiny. Now, proposed reforms are set to potentially reshape its trajectory.

- Despite

billions invested and some success stories like downtown Erie, PA, the

program faces criticism for potentially favoring already improving

areas.

- Proposed reforms, focusing on enhanced oversight, aim to boost the program`s effectiveness and ensure fairer outcomes in community redevelopment.

RSK: OZ`s are still out there...good article on why they haven`t taken off as planned.

Consider Opportunity Zones for Reallocating Capital Gains

Tax season can introduce a whole host of decision-making challenges into an investor’s portfolio. Some assets can be sold to harvest losses, while others may be sold because it is a profitable time to sell.

Tax season can introduce a whole host of decision-making challenges into an investor’s portfolio. Some assets can be sold to harvest losses, while others may be sold because it is a profitable time to sell.For investments that have generated capital gains, there are further decisions to make—is it time to pocket the profit and pay taxes? Or are there opportunities to defer capital gains taxes and generate tax-free growth by investing in new assets?...

...Full Story Here

RSK: If you have some cap gains coming up might not be a bad idea to invest in something like this. Just be careful As the song goes "don`t be chasing waterfalls...stick to the rivers and streams that you`re used to" in other words...try to stay local.

About CirexNews.com

Five Years In, Opportunity Zones are Hitting Their Stride

A question looming over the industry is whether the legislation will get renewed or if the benefit will fade once the law expires.

Opportunity Zones (OZ) are defined as an economic development tool that allows people to invest in distressed areas in the United States....

RSK: Doesn`t seem like 5 years since they came on line....just took 5 years for developers and the municipalities to figure out how they were going to work together and what the benefits.

Unlock Impressive Tax Incentives (USA) on Your Recent Capital Gains From The Sale of A Business, Stocks, Crypto, Stock Options, Property, or Other I

Are You Sitting On Capital Gains In Need of Some Tax Advantages? Important Deadlines Are Rapidly Approaching.

Are You Sitting On Capital Gains In Need of Some Tax Advantages? Important Deadlines Are Rapidly Approaching.Learn How To Tap Into The Power of Opportunity Zones and Unlock Impressive Tax Incentives With Compounding Potential...

RSK" Although this is a prom, it does go into the benefits of Opportunity Zone Investments. And yes, there is still time to back track and save a bunch of capital gains. even if you have already filed your taxes. Read on.

Tax break for the rich: How investors exploit opportunity zones

VIDEO: Opportunity zones were supposed to encourage investment in low-income communities. But billionaires are building luxury hotels and high-rises, instead...

RSK: There will always be some scoundrels that take advantage of a system and law....ahhh, the best laid plans of mice and men...

OZ Investments Surge As The Program Attempts To Emerge From The Uncertainty Of Its Early Years

A year-end deadline for tax benefits and more clarity made 2021 a banner year for the opportunity zones program, with $6.9B invested in qualified opportunity funds in the latter half of the year, up 39% from the first half of the year, new data shows.

A year-end deadline for tax benefits and more clarity made 2021 a banner year for the opportunity zones program, with $6.9B invested in qualified opportunity funds in the latter half of the year, up 39% from the first half of the year, new data shows. California is top of mind for OZ investors, as are residential projects, according to a report from accounting and consulting firm Novogradac...

...Full Story Here

RSK: Many were worried that OZ would just be a tax shelter for the rich...but you need some incentive for them to take the risk and in the long run it hopefully works out for everyone involved...kind of like TIF money...

What investors must know about opportunity zones before 2022 and beyond

There isn’t much time left for real estate investors to take advantage of one of the biggest perks of opportunity zones.

There isn’t much time left for real estate investors to take advantage of one of the biggest perks of opportunity zones.Opportunity zones—a program started under the Tax Cuts and Jobs Act of 2017—are economically distressed areas where the government hoped to create jobs and increase spending through tax incentives to investors...

...Full Story Here

RSK: Even if you miss this years deadline, there is still value in Oz`s. Just make sure that the investment is a good without the OZ benefits and you should be okay!

Property Prices Jump 20 Percent in U.S. Communities Named Opportunity Zones

RSK: We knew this would happen. If it goes too far and prices rise too high, the benefits may not outweigh the costs and the property program may not do what it is supposed to...

Former Shopko

Ideally situated between east and west Madison, this former Shopko offers 97,931 sf plus a 21,850 sf mezzanine. The property is located in an opportunity zone, zoned CCD (Community Design District). 2 outlots included in the sale provide an excellent development opportunity. The parking ratio is 6.2:1,000 and the location offers high visibility along the Beltline Hwy with 117,000 vehicles daily...

...Full Story Here

Building For Sale: Former Shopko Former Shopko 2101 W Broadway Monona WI

Ideally situated between east and west Madison, this former Shopko offers 97,931 sf plus a 21,850 sf mezzanine. The property is located in an opportunity zone, zoned CDD (Community Design District). Possibility to create 2 outlots provides an excellent development opportunity. The parking ratio is 6.2:1,000 and the location offers high visibility along the Beltline Hwy with 117,000 vehicles daily.

...Full Story Here

Land for Sale: 2106 W Badger Rd Madison WI

Great Central Beltline Location. Hard to find 1.81 acre commercial site with great linkages to East/West/South Madison and Fitchburg. Located in an Opportunity Zone. Utilities at lot line. Adjacency to Arboretum provides an unique setting for many possible uses.

...Full Story Here

There Are 9 Simple Steps To Great #CRE Content Marketing, What Are You Missing?

I have been hitting #CRE pretty hard lately and have taken some serious shots at #CRE media, brokers, startups, old people, young people, their egos and practices, the process of, the general state of, and so on and so on. And there has been some pushback, with that there have also been those that are happy that I “call out” #CRE for all of its pains and ills. I have understood since day one the way to win or influence an audience is to entertain, inform, and educate. It’s easy to see why that works, it’s generally what we all want. How hard is it really to come up with a Top 10 listicle post and push it out once a month? You see them all the time, Top 10 Ways To Improve, Top 10 Mind Blowing, Top 10 People, Top 10 Most, Top 10 Greatest. And for some even doing that is too much time and effort...

...Full Story HereRSK: Love this article. If you want to start creating content just let Ken or me know and we will create an easy to use program for you...but it will take a bit of work on your part. After all, nothing free or unearned is worth it.

Ken Notes: Yep, in front of your clients every week with useful information makes you the expert, and not a lot of work just provide more insight than they can get from "Googling it". Here is an example want to know about everything about Opportunity Zones, just click the link and Ralph and I will hook you up.

Podcast: Tony Nitti on Opportunity Zones Tax Benefits

OpportunityDb’s Jimmy Atkinson interviewed Tony Nitti, real estate tax law expert, CPA, and partner at Withum. He also serves on the editorial advisory board for The Tax Adviser. And he’s a contributor at Forbes.com, where he recently published a thorough primer on the opportunity zones tax incentive.

Click here to listen as Tony and Jimmy dissect the basics of the opportunity zones tax code, explore some unintended consequences and loopholes introduced by the proposed IRS regulations, and discuss who the actual drivers behind most opportunity zone investments will be...

Ken Notes: This is like a masters class in OZ`s plus you can search CirexNews Archives for Opportunity Zone Here to learn more that you need to know. We archive every story for ever - who loves you baby...

IRS Releases Additional Reporting Requirements For Opportunity Zone Investing

A clear picture of the opportunity zone program remains out of reach, but more information trickled out of the Internal Revenue Service at the end of October.

The IRS released a draft version of Form 8996, the filing document for qualified opportunity funds and their investors, containing additional requirements for reporting opportunity zone-related income, Bloomberg Tax reports.

If the current version is finalized, Form 8996 would require a QOF to disclose how it is structured, as well as all of its assets and their respective census tracts. The census tract, employer identification number and assets will be required for any qualified opportunity zone businesses that are listed among a QOF`s assets...

RSK: On a similar note....

Ken Notes: Remember you an search CirexNews and there are dozens of articles on opportunity zones starting the day they were created to this one...

Motels Could Be The Right Fit For Opportunity Zones

Budget and value hotels are poised to see a boost in investments via the opportunity zones program, experts told Bisnow last week.

G6 Hospitality Vice President of Franchise Development Jeff Stephenson said that in the past year, he has already heard from more than two dozen investors and current motel owners exploring ways to take advantage of the federal tax program. G6 Hospitality oversees more than 1,400 Motel 6 and Studio 6 extended-stay brands in the U.S. and Canada...

...Full Story HereRSK: Yes, hospitality is one use but I am not sold on them bringing or creating that many jobs at the wages they pay.

Numbers Show California`s Opportunity Zones Investments In The State Are Down

In the nearly two years since the passage of a federal program aimed to spur economic development in low-income and distressed neighborhoods, there have been roughly 30,200 commercial real estate transactions in the designated opportunity zones in California.

In the two years prior to the program, there were more than

32,200 commercial real estate transactions in the same zones in the

state, according to CRE data site Reonomy...

RSK: One begins to wonder if this was such a good idea. Seems it just might be inflating the value of properties in the Zones.

Ken Notes: It depends on who is running the show. They are a GREAT idea if you can invest in an area where you will see gains during the investment period. In California they are more risky because you can "do better" outside the zone. You need to be very smart to make them work for you.

Final Opportunity Zone Regulations Released By Trump Administration

Two years after the opportunity zone program became law, the final round of regulations about how they will be implemented has been released to the public.

The Treasury Department and the IRS published the 544-page document Thursday afternoon with a number of substantial changes and additions from previous iterations of guidance. Treasury Secretary Steven Mnuchin said in a statement that the new regulations will provide "clarity and certainty" to investors that will allow for more capital to flow into opportunity zones....

...Full Story HereRSK: Finally have some clarifications on OZ’s. Allowing partnerships to sell of separate parcels and properties being one of the biggest.

Ken Notes: And now for your Christmas entertainment, 544 pages of ways to make friends at the IRS. Oh and in case you did not know this, GOLF is a sin...

The Looming Dec. 31 Opportunity Zone Deadline: What It Means For Investors

On Dec. 31, when the rest of the world is getting ready to usher in the new decade, opportunity zone investors will face an important deadline: the last day on which they can make an investment in a qualified opportunity fund and get the full benefit of the new program.

Created as a vehicle in which investment flows to opportunity zones to reap the highest possible tax benefit on deferred capital gains and spur growth, the program has set timelines...

...Full Story HereRSK: Yikes, less than 12 hours to get it done...so if you haven`t done it by now kiss that extra 5% good-bye.

Why The Rest Of 2019 Will Be Crucial For Opportunity Zone Development

Despite his location in one of the country`s hottest real estate markets, Urban Catalyst Managing Partner Erik Hayden employed a wait-and-see approach to San Jose`s opportunity zones.

Even after having set up Silicon Valley`s only multi-asset fund dedicated to designated properties, he waited.

As Hayden recognizes, stories similar to his occurred in markets

across the country, with investors claiming a lack of clarity

stalling any kind of large-scale benefits opportunity zone, which proponents promised would come to distressed communities...

RSK: Womp, Womp! I think everyone was expecting OZ`s to go ballistic but the process is slow and probably won`t see much coming out of the ground for another year.

The 7 Most Important Things We Learned From The Latest IRS Opportunity Zone Regulations

With the unveiling of the highly anticipated second set of proposed regulations related to opportunity zones, 2019 is going to be a big year for investors wanting to take advantage of the much-hyped federal program.

By Wednesday afternoon, commercial real estate professionals, investors and others were poring over the 169-page regulations released by the IRS and the U.S. Department of the Treasury.

"From what we’ve seen so far, this is a positive step,” EIG President and CEO John Lettieri said. “This removes a lot of the obvious impediments that have kept capital on the sidelines to date … I think it’s going to free up a lot of capital."..

...Full Story HereRSK: Finally IRS clears up some of the major questions regarding Opp Zones. No triple net leases folks but you can pass it on to your heirs are just a few clarifications. Read this one.

The Real Opportunity Zone Gold Rush Is Happening At Events, In Consultants’ Offices

For the past couple of years, opportunity zones

have been a rolling thundercloud of interest, excitement and debate

hovering over the real estate industry. But the lightning it promised

has yet to strike.

Since the opportunity zone program was introduced, the flurry of investment activity that its architects foretold hasn’t materialized. In its place, an ecosystem of events, media, marketing and paid consultation has arisen and flourished — an industry based on talking about opportunity zones rather than investing in them...

...Full Story HereRSK: What is happening is money being spent on the learning curve....and professional help is needed to navigate these muddy waters thus driving out some non-profits that would look at OZ`s....they just cannot afford the prelim.

Lenders Don`t Care If Your Project Is In An Opportunity Zone

Opportunity zones have generated nationwide excitement since they were introduced, but a maxim has been repeated ad nauseum to temper that enthusiasm: An opportunity zone doesn`t turn a bad deal into a good one.

While the capital gains tax benefits only apply to equity investments, a real estate deal done without debt is a rarity. For commercial real estate lenders, the maxim holds true — opportunity zones don`t change the fundamentals of a deal...

...Full Story HereRSK: I have been saying this all along...it has to make economic sense without the added benefits of the OZ.

Mnuchin Says No To Weed For Opportunity Zone Investing

It seems that one of the lingering questions regarding opportunity zones has been answered, eliminating a possible avenue of investment.

In a hearing of the Senate`s Appropriations Committee, Treasury Secretary Steven Mnuchin "advised against" the use of qualified opportunity funds to invest in cannabis businesses, Bloomberg Tax reports. Mnuchin said the cannabis industry doesn`t align with the spirit of the legislation that created opportunity zones.

The law in question, the Tax Cuts and Jobs Act of 2017, banned the use of opportunity funds to invest in what the U.S. Tax Code defines as "sin businesses": liquor stores, casinos, racetracks, golf clubs, tanning salons and massage parlors, among others. Because cannabis is still illegal under federal law, there was no provision for its inclusion on the list.

...Full Story HereRSK: Mnuchin was probably a hippie in his college days so what happened?

Qualified Opportunity Zones

What are they?

Congress created the federal Qualified Opportunity Zone (“QOZ”) program in the 2017 “Tax Cuts and Jobs Act” to encourage economic growth in underserved communities through tax benefits to investors. U.S. states and territories, including Washington, DC, nominated areas (by census tract) to be designated as QOZs in 2018, and the IRS and Treasury finalized the designations that year. This program presents opportunities for real estate investment and development in distressed communities.

How does the program work?

Forming an Opportunity Fund:

Fulfilling the “90% Assets” Requirement:

QOZ Business Property Requirements:

What are the tax benefits?

For capital gains reinvested into an O Fund:

For future capital gains on investments accrued while in an O Fund:

...Full Story Here

18 Commercial Real Estate Trends To Dominate In 2019

Goodbye 2018, hello 2019! As the new year approaches, Bisnow spoke with several industry execs, researchers and economists to uncover the major trends expected to dominate the commercial real estate industry in the coming year. From the rise of opportunity zones to a slowdown in industrial absorption, these are 18 trends experts forecast for 2019.

1. Opportunity Zones Craze To Persist...

2. Industrial Boom To Continue Thanks To High Demand From E-Commerce Players, Though A Few Headwinds May Surface...

3. Federal Reserve To Gradually Boost Interest Rates Due To The Strength Of The Economy...

4. Online Retailers Will Continue To Open Brick-And-Mortar Stores, Further Validating That Physical Retail Is Far From Dead...

5. Industry To Continue Reading The Tea Leaves To Predict The Next Downturn...

...Full Story HereRSK: For me, #3,4 & 9 are important factors in my decisions however, they all have merit.

Trump Is Getting Involved In Opportunity Zones, And Experts Think That`s A Good Thing

Opportunity zones have become the darling of real estate investors since their adoption last year, but the still-under-the-radar program is poised to receive a lot more attention, and possibly scrutiny, after it was promoted in the Oval Office last week.

President Donald Trump`s signing of an executive order to push more federal resources into the Opportunity Zone program is a step in the right direction and could bolster the little known tax incentive program and the distressed communities that benefit from investments, experts said. ...

RSK: OZ`s have certainly become the darling of CRE but let`s see how they actually pan out. Remember the mid 80`s when doing deals for tax breaks took a nose dive. Learn from the past. The deal has to stand on its own...the tax incentives are just a bonus for the risk!

Can Indoor Farming Fulfill The Dream Of Opportunity Zones?

Opportunity zones and indoor farms are both new frontiers for investment, and one company is seeking to combine them.

Zale Tabakman has developed a concept for an indoor farm that grows greens, herbs and vegetables using modular construction, called Local Grown Salads. One LGS farm would be 15K SF and fabricated off-site almost entirely — even the HVAC system, often one of the costliest elements of construction. All the site needs is for the walls, floor and ceiling to be sealed and the water and power to be connected to the grid...

...Full Story HereRSK: Human ingenuity never ceases to amaze me.

Tax Code Updates Mean Cost Segregation Studies Are More Important Than Ever

The Tax Cuts and Jobs Act of 2017 sent ripples through commercial real estate, thanks largely to the revelation of opportunity zones. But a few TCJA tax code changes could be even more influential. One that has tax professionals abuzz is bonus depreciation, which can save large amounts of money no matter the project.

Bonus depreciation allows taxpayers to write off a portion of an asset in the year it was acquired as long as that asset has a sufficiently short life span. Personal property like plumbing systems, for instance, have a shorter life span than a building structure itself, and can be written off. The TCJA doubled bonus depreciation on eligible assets, from 50% all the way to 100%...

...Full Story HereRSK: This may help rectify the tax code 39-year depreciation mistake in the above article but not all of it.

Opportunity Zones vs. 1031 Exchanges: Weighing the Options March 27, 2019

While the tax benefits of Section 1031 exchanges in commercial real estate are well-known to most practitioners, the new qualified opportunity zone program now offers another approach to deferring or eliminating taxable gain. Qualified opportunity zone investments in commercial property can be similar to 1031 exchanges, to defer taxes, but the differences in tax implications can be significant when there is a disposition of the property. Plus, the lack of well-established case law, regulations, and other guidance for investments in qualified opportunity zones creates risks — risks that should be considered carefully before investing in opportunity zones. Join CCIM Institute and experts Dr. Mark Lee Levine, CCIM and Libbi Levine Segev, JD, LLM to hear how you can best leverage both options and tackle the unique challenges of each. Of course, there are other alternatives that will be examined, beyond undertaking the use of an Opportunity Fund or a 1031 transaction...

...Full Story HereRSK: A free course from CCIM on Opportunity Zones and 1031 Exchanges.

The Opportunity Zone Regulation Delays Could Be Good News For Philadelphia

For all the intrigue that opportunity zones have generated, they have also come with their fair share of concern. But as the delay in final regulations drags on, it may also solve one of the program`s problems by accident.

The most talked-about facet of opportunity zone investing so far has been the 15% discount on capital gains invested in the zones if held for seven years, but that only applies for investments made by the end of this year. Some movement is already happening, like Plymouth Group’s purchase of the former Budd Co. factory where Bisnow held its Philadelphia Opportunity Zones and Capital Markets event last week...

...Full Story HereRSK: One of the problems with OZ`s will be attracting the quality tenants to fill the space.

Is Opportunity Zone Investment Worth the Risk?

Federal initiatives designed to incentivize private investment in low-income communities have been around for years, often with mixed results.

Today, “Opportunity Zones,” a program inserted into the new tax law, holds a lot of promise but represents a dramatic departure—with considerably more risk—from New Markets Tax Credits, a time-tested tool favored by real estate developers since the early 2000s...

...Similar to the like-kind 1031 exchange, Opportunity Zones are designed to reward long-term investment by deferring or abating capital gains taxes. Initially, investors defer their unrealized capital gains by reinvesting into an Opportunity Fund. They’re taxed on just 85 percent of that original investment, as well as proceeds, if they stay in the fund for seven years. If an investment is held beyond 10 years, investors are only responsible for paying taxes on the original investment, making it the more cost-effective option...

RSK: We had this very same topic at our RASCW Commercial Update Seminar on Wed the 23rd. There is opportunity here but need to know where the zones are and the risk.

Ken Notes: Like other zones or districts the key will be to get one or two businesses in the zone that generate growth for the investors. Then the risk factor is minimized as new startups come and go. If I had a zone I would look for a distribution center as an anchor..

Ken Note on CirexNews Search Feature...

Here is a link to search anything your commercial real estate heart desires! (try REIT for example)

Members Of Congress Want Inspector General To Take A Hard Look At OZs

U.S. Sen. Cory Booker

(D-N.J.), Rep. Emanuel Cleaver (D-Mo.), and Rep. Ron Kind (D-Wis.) are

calling on the Treasury Department to take a close look at the process

by which opportunity zones have been created.

The move comes after reports of zones created that do not meet the eligibility criteria. One in particular, in Downtown Detroit, purportedly benefits properties owned by billionaire Dan Gilbert, chairman of Quicken Loans and owner of the Cleveland Cavaliers, ProPublica reports. Gilbert previously donated $750K to the inaugural fund of President Donald Trump.

...Full Story HereRSK: Always some politico involved somehow, somewhere.

Ken Notes: I did my radio show, Development Matters, last week on Property Zones and while there are Funds that individuals (who have capital gains) can invest in, this program is for the investor or developer who has professional guidance and substantial capitol gains. So yes the wealthy and uber wealthy will benefit most. The question is are they creating jobs and improving neighborhoods.

9th Annual Madison | Southern Wisconsin Commercial Real Estate Forecast Summit

7:30 am – 11:00 am CST

Sheraton Madison Hotel

706 John Nolen Drive

Madison, WI 53713

7:30 am

Registration, Networking & Breakfast

8:00 am

Madison Area Market Update: Industrial, Office, Retail and Multifamily

- How COVID-19 has impacted the commercial real estate market

- What are the strongest and weakest CRE sectors in today’s climate

- Recap on major transactions and developments that have impacted the market

- How can investors maximize their returns in today’s climate?

- Future outlook for Industrial, Office, Retail and Multifamily sectors

9:20 am

Financing & Tax Strategies for Real Estate Professionals

- Stimulus Update

- Overlooked stimulus opportunities: ERTC and SBA provisions have huge impact

- Opportunity Zones: Current opportunities and potential for expansion

- Bonus depreciation: Last chance for a bite of the apple

- 1031 Strategies & other tax opportunities investors need to know

10:10 am

Southern Wisconsin Economic Development Update and Opportunities in the Region

- What tools or Strategies has your community identified as a game changing development tools?

- Funding Strategies to get your deal done

- Redevelopment, new development and where it’s taking place

- Investment Opportunities in the Region

- Development Opportunities in the Region

11:00 am

Adjourn

...Full Story Here

Looming Deadline Kicking Off A Flurry Of Opportunity Zone Investment

A key deadline is approaching for investors looking to maximize the benefits of the opportunity zone program, and fund managers are preparing to receive an influx of capital in the coming months.

The opportunity zone program, passed into law in late 2017, comes with a series of incentives for investors to finance real estate projects and businesses in census tracts designated as needing investment. While the program will still provide benefits to investors for several more years, one of its incentives has a deadline for investors to place money into funds by the end of this year....

RSK: If you are thinking of investing in an Opportunity Zone a major deadline is coming up Dec. 31st.

Qualified Opportunity Zones A Brief Primer

If you are planning to acquire or build a senior living facility that is located in an opportunity zone, there are many tax benefits that are available to you. One of these benefits is that 10% of the capital gains that you defer when you make your investment in an opportunity zone will be forgiven, provided your investment is made by December 31, 2021, and held for at least 5 years.

Time is running out on when you can make your investment. However, while the investment must be made before year end, your acquisition can occur after this date if you properly structure your transaction to take advantage of the working capital safe harbor.

Please see full Publication for more information...

...Full Story Here

RSK: Might be time to hone up on OZ. It just isn`t multifamily but includes retail and industrial options as well. Download the PDF and read at your leisure. Things have been very quiet regarding OZ lately and there might be some real opportunity here.

Senate flip: 5 real estate takeaways

Biden now has better shot at changing taxes, Opportunity Zones

That changed Wednesday when two Democrats won Senate seats in Georgia. Biden’s proposals have a better chance of making it to the floor with Democrats holding half of Senate seats, Kamala Harris poised to cast tie-breaking votes as vice president and Sen. Charles Schumer, D-New York, as majority leader...

- Tax deductions and rates...

- 1031 exchanges...

- Opportunity Zones...

- Next round of stimulus...

- Federal eviction moratorium...

RSK: If you are involved in real estate in any way, you need to read this.

Ken Notes: Good read, we may need to get proactive on the CRE front and demonstrate we can create jobs and revenue...

Biden and Commercial Real Estate: 4 Intersections to Watch

Changes to opportunity zones, affordable housing, 1031 exchanges and SALT, plus another stab at Infrastructure Week

The pandemic

The coronavirus pandemic is by far the biggest challenge that commercial real estate faces. The virus has emptied offices and hotels; caused a spike in loan delinquencies and a drop in real estate investment trusts’ stock performances; tanked leasing and sales; and banged perhaps the loudest death knell yet for brick-and-mortar retail. Until the coronavirus is under control, industry analysts, owners and brokers say a return to (a new) normalcy in the market and the industry is out of the question....Infrastructure...

Affordable housing...

Tax breaks...

RSK: Will be interesting to see how much of this comes to fruition. Most depends on the Senate and who will control it. We won`t know that until the run off races in Georgia next Jan.

Ken Notes: READ THIS ARTICLE. One of the things we need to do is look for the programs under Trump that worked, and there were many, then advocate for keeping these to improve the economy. We have a real opportunity to seek policy that help CRE but we need to get to the table fast or we will be seen as the cash cow for other initiatives...

What Biden Could Mean for Opportunity Zones

One observer thinks there is a chance the program could be rolled into a massive stimulus package.

“It came out of his [the Obama] administration, and I think that’s important,” states Christian. “Biden’s public statements are relatively supportive of continuing the Opportunity Zone program and his suggestions are pretty minor, like more transparency and making sure that they’re invigorating the poor neighborhoods and not just enriching business people.”

As a tax practitioner, Christian’s primary concern is Biden’s talk of increasing tax rates, specifically his plan to raise taxes for those making more than $400,000 a year. Opportunity Zone investors get a tax deferral until 2026.

RSK: It looks like Biden has or will win so CRE investors need to read this and plan ahead.

Republican Or Democrat, The Opportunity Zone Program Will Likely Change Next Administration

RSK: A good idea with too many bad loopholes...it totally needs reform.

Ken Notes: I have done two radio shows, read dozens of articles, and written an article on OZ`s and it is clear the winners are lawyers and accountants and very wealthy individuals with large cap gains issues. It has not provided as much stimulus or investment as projected. I have also had the opportunity to ask two elected officials who voted for this to explain it, and off the record they were not even close to understanding the details. I can not wait for the presidential debates....

Qualified opportunity zones

Overview of final regulations and practical insights

In December 2019, final QOZ regulations were released, bringing much needed clarity to investors. On this webcast we will provide an overview of the final regulations and practical takeaways for funds, QOZ businesses and investors.

Join us as we discuss:

- Definition and timing of eligible gains, and the 180-day investment window

- Original use, substantial improvement and aggregation rules

- Self-constructed and leased property considerations

- Working capital safe harbor criteria and applicability

- Gain inclusion events

- Basis adjustments for QOZ investments

- Exit considerations

RSK: The latest on Opportunity Zones in a podcast.

Half of U.S. Homes Located in Opportunity Zones Saw Price Increases in 2019

ATTOM Data Solutions has reported this past week that about half U.S. opportunity zones, where there was sufficient sales data, saw median home prices rise more than the national increase of 9.4 percent from the fourth quarter of 2018 to the fourth quarter of 2019.

Based on ATTOM Data Solutions new report, 78 percent of the zones had median U.S. home prices in the fourth quarter of 2019 that were less than the national median of $257,000 - almost the same percentage as in the third quarter of 2019. Some 48 percent of the zones had median prices of less than $150,000.

"Home prices in thousands of Opportunity Zone neighborhoods targeted for revival across the United States continued to ride the tide of the national housing market boom in the fourth quarter of 2019, marching along with broad trends and even doing better in many areas," said Todd Teta, ...Full Story Here

ATTOM Data Solutions has reported this past week that about half U.S. opportunity zones, where there was sufficient sales data, saw median home prices rise more than the national increase of 9.4 percent from the fourth quarter of 2018 to the fourth quarter of 2019.

Based on ATTOM Data Solutions new report, 78 percent of the zones had median U.S. home prices in the fourth quarter of 2019 that were less than the national median of $257,000 - almost the same percentage as in the third quarter of 2019. Some 48 percent of the zones had median prices of less than $150,000.

"Home prices in thousands of Opportunity Zone neighborhoods targeted for revival across the United States continued to ride the tide of the national housing market boom in the fourth quarter of 2019, marching along with broad trends and even doing better in many areas," said Todd Teta, ...Full Story HereRSK: We knew this might happen and at the moment it will increase the tax base but no doubt most of the people may not be able to pay the taxes on the higher assessments.

Opportunity Zones Take Shape Despite Mixed Reviews

Skeptics of the Opportunity Zone program claim few deals are being done in the 8,700 designated census tracts beyond the “low-hanging-fruit” that was already in investors’ pipelines. The benefits that allow investors to reduce or potentially eliminate their capital gains tax liabilities, they say, are not really going to investors engaged in the deliberate community renewal that is supposed to be the program’s mission. But at the Connect Opportunity Zone conference in New York City last week, it was clear that community-minded investment is underway in these districts.

RSK: Yes the process has been slow mainly because the learning curve and municipal approval process takes time. However, the jury is still out if there will be substantial development in the Zones.

2019 Sun Prairie Showcase Materials

Tour Route Map (Link to PDF)

Tour Points of Interest Information (Link to PDF)

Park 151 Information - Interstate Partners (Link)

Sun Prairie Business Park Expansion Area (Link to PDF)

Sun Prairie Opportunity Zone Info Sheet (Link to PDF)

11 Upcoming Real Estate Trends Poised To Impact Agents And Investors

To help highlight these developing trends and what they mean for the agent or the investor, Forbes Real Estate Council

members discuss some of the developing real estate trends likely coming

to the industry in the next few years and how those changes would

impact the average investor or agent...

1. Co-Working Space As A Shared Amenity...

2. Growing Sense Of Community...

3. Property Tech And AI Disrupting The Industry...

4. Rise Of Opportunity Zones...

5. Millennials Will Start Buying Houses...

6. Spread Of Shared Living Spaces...

7. Short-Term Rentals At Higher Rates...

8. Rent Control With Upzoning Measures...

9. Increased Use Of Freelance Workers...

10. Build-To-Rent Boom...

11. Modular Buildings Reshaping Construction...

RSK: This is interesting. See what your peers think and if you agree with them.

Opinion: Opportunity zones are all sizzle, fizzle and the abuse of good intentions

An effective program to address problems in low-income communities already exists — without creating more tax breaks for the wealthy

Opportunity zones, a bundle of tax breaks dressed up as economic development, are the epitome of government largess the Trump way — sizzle, fizzle, a sleight of hand and abuse of good intentions.

Created with fanfare in the deeply regressive 2017 tax reform law, opportunity zones are the latest and slickest version of the longstanding conservative strategy of taking from the poor to help the rich. Trump’s twist makes these all the sweeter for conservatives because they pretend to address problems Democrats care about, like providing affordable housing and creating good jobs for the people who live in low-income communities. The results to date show that the outcomes are more likely to be luxury apartments and sparse jobs, not affordable housing and employment opportunities...

RSK: Yes....the road to hell is paved with good intentions. But let`s not give up hope on OZ`s yet. There still is real opportunity. But what do you expect investors to do? Of course, build and invest in the best money producing asset class luxury housing. The investment needs to make sense without the tax benefits which are just icing on the cake.

Businesses Are Missing A Lucrative Part Of Opportunity Zones, Experts Say

Most investors have focused on the real estate investment side of the federal opportunity zone program, but many are missing out on a part of the program that could generate far greater returns, experts said.

The returns on investing in a high potential company that sets up as a qualified opportunity zone business, or QOZB,

and starts or relocates in one of the designated 8,700 opportunity

zones could be 10 times more profitable than flipping commercial real

estate, The Pearl Fund founder and Managing Partner Brian Phillips said.

RSK: Another altruistic way and viewpoint on opportunity zones.

The Five Perils of Opportunity Zones with Neal Bawa ~ Live Show

TODAY - TUESDAY 8/27/2019

This is our first in our weekly series of live-streaming shows, focused on Opportunity Zones. Neal Bawa will serve as our master or arms and talk about, “The Five Perils of Opportunity Zones”. To attend the live-stream, ask questions, leave comments and participate in the conversation, click the following links at 2:45, PM on August 27, 2019:

YouTube https://youtu.be/v6HPBHJodDs

Facebook https://www.facebook.com/creradioandtv/

Twitter/Periscope https://www.periscope.tv/CREradio

Who Should Watch and Listen

This show is for anyone who has sold or is thinking about selling property and is looking to reinvest their capital gains and minimize the taxes owed on capital Gains. It should also be of interest to real estate brokers, accountant, attorneys and business brokers and investors.

RSK: Live today

AT&T surplus real estate auction set for October

AT&T will sell 37 real estate properties this fall through Williams & Williams, a specialist in global live and interactive real estate auctions. The assets are located in nine states and are selling in a combination of on-site and online auctions organised between 16 and 25 October. Williams & Williams will conduct the auctions in conjunction with strategic broker partner JLL.

AT&T is offering each property separately for auction and most will come with leaseback deals in place. The properties include industrial and office, and several have potential for significant redevelopment. The properties are located in regional markets in AL, FL, IL, IN, LA, GA, OH, SC, TN and WI. Two properties in Opportunity Zones are in Marion, AL and Euclid, OH...

https://www.auctionnetwork.com/search/wisconsin

...Full Story HereRSK: Yes, Wisconsin is on the list but it does not say how many and where. You might need to go to the auction site to find out if interested. Just found out that 1 is in Appleton and the other in Stevens Point which looks to be a cellular retail site.

Ken Notes: I added a link to the current Wisconsin properties on the site...

WHAT TO KNOW ABOUT OPPORTUNITY ZONES

Opportunity Zones are the most exciting investment vehicle that I have

seen in my 43 years as a real estate professional. In this video, In

this video I explain who should be thinking about Opportunity Zones, why

and what you need to know. This is for people who are concerned about

their capital gains taxes... ...Full Story Here

Opportunity Zones are the most exciting investment vehicle that I have

seen in my 43 years as a real estate professional. In this video, In

this video I explain who should be thinking about Opportunity Zones, why

and what you need to know. This is for people who are concerned about

their capital gains taxes... ...Full Story HereRSK: And we need to know more....very timely.

Opportunity Zones in Wisconsin

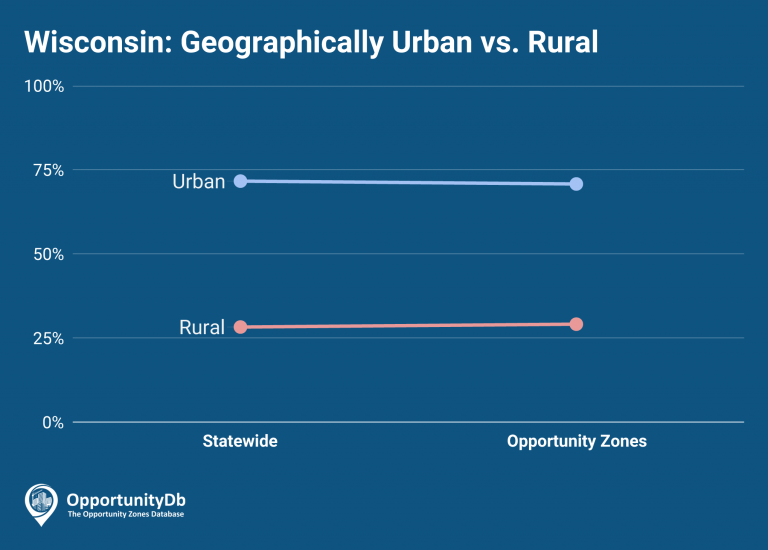

Wisconsin has 120 designated opportunity zones, all of which are low-income communities. Wisconsin did not designate any eligible non-low-income contiguous tracts as opportunity zones.

Urban vs. Rural

Wisconsin’s opportunity zone urban-to-rural ratio is nearly identical to the statewide ratio. Among Wisconsin’s 120 opportunity zones, 71 percent are urban, and 29 percent are rural.

...Full Story HereRSK: Here is a map of OZ`s in Wisconsin.

Is an Opportunity Zone the Right Investment for You?

The hottest pitch in real estate is the opportunity zone, one of 8,700 geographic areas in the United States in need of economic investment.

Opportunity zones encompass three enticements that make real estate attractive to professional investors: the promise of change in underserved areas, the chance of an outsize investment return and the opportunity for a huge tax break...

...Full Story HereRSK: Even with all the tax incentives of OZ`s, the investment still needs to make sense economically without them.

Opportunity Zone Investments Explained

A flood of new funds are rising up to help investors take advantage of the new tax breaks, but hedge fund-like fees, risky projects and a lack of oversight could lead your client down a black hole.

The opportunity zone tax benefit has received a lot of attention. The program, born out of the Trump administration’s tax overhaul, lets investors defer and reduce capital gains taxes in exchange for investing the money in designated low-income neighborhood development projects. No doubt some clients are asking advisors about it, and there has been a proliferation of investment funds launched to accommodate the demand.

But experts say while the incentives have the potential to be a great deal for all involved, clients need to be aware there is no guarantee their investment will work out as planned, nor any certainty they’ll help the distressed communities they are targeting....

RSK: One of the better explanations of an OZ.

New Apartment Deliveries Increase Demand for Property Management

New apartment deliveries are creating more demand for property

management companies. Research from CBRE estimates that the top 66

metros in the US will deliver a total of 300,000 new apartment units

this year. That is a 15% increase over 2018 deliveries. Multifamily

investment will also increase this year, with an expectation of more

than $150 billion in multifamily investment. Opportunity zone funds will

also fuel additional investment this year as well. New deliveries will

mean two things for property managers: more competition at existing

assets under management and new demand from developers for property

management representation... ...Full Story Here

New apartment deliveries are creating more demand for property

management companies. Research from CBRE estimates that the top 66

metros in the US will deliver a total of 300,000 new apartment units

this year. That is a 15% increase over 2018 deliveries. Multifamily

investment will also increase this year, with an expectation of more

than $150 billion in multifamily investment. Opportunity zone funds will

also fuel additional investment this year as well. New deliveries will

mean two things for property managers: more competition at existing

assets under management and new demand from developers for property

management representation... ...Full Story HereRSK: The best thing will be more competition and pricing. There is a point where the amenities are not worth the rent increase for new properties.

Five Trends That Will Impact Real Estate Investing This Year

Let’s be honest: Real estate valuations are very high today. But worries of an impending housing crash are premature. There are many trends that could continue to drive real estate values. A millennial middle class hungry for the independence of owning a home and a reasonable economy outweigh housing indicators that might signal a downturn is imminent. That doesn’t mean U.S. real estate markets are not in a pivotal phase. In fact, 2019 is poised to create significant opportunity for those who understand the five significant economic and demographic trends driving the market. Let’s consider the following five trends:

1. Rise in Interest Rates...

2. Millennial Homebuyers Enter The Market...

3. Growth Of Secondary Cities...

4. Housing Affordability...

5. Impact of Opportunity Zone Funds...

...Full Story HereRSK: Not sure the author hit the mark on this one.

The Future of Real Estate Investment: Opportunity Zones

According to the 2017 Distressed Communities Index by the Economic Innovation Group, one in six Americans, approximately 17 percent of the population, live in economically-distressed communities, and the average state has 15.2 percent of its population living in these struggling areas.

The new Opportunity Zone (OZ) tax incentive was created as part of the 2017 Tax Cuts and Jobs Act to encourage investment in low- to moderate-income communities across the country through tax benefits, such as deferring tax on capital gains by making an investment in any of the designated zones. So far, 8,761 communities covering all 50 states, including the five U.S. territories, have been designated as opportunity zones, and they will keep this status for 10 years....

...Full Story HereRSK: Read the section under RISKS. What I see in opportunity zones is the ability to gnaw away at some blighted areas from the outside perimeters and hopefully, eventually, engulfing it.

Investor guide to opportunity zones

A RealCrowd audiocast

AUDIOCAST |

The 2017 Tax Cuts and Jobs Act created a new investment vehicle intended to stimulate economic growth in distressed communities. Qualified opportunity zones (QOZs) are pre-selected areas around the United States where investors can hold capital gains for preferential tax treatment while struggling communities can benefit from an influx of development and funding.

...Full Story HereRSK: ANother version of Opportunity Zones worth the listen.

The 14 Deals And Trends That Defined Real Estate In 2018

Aside from Amazon HQ2 (which all began last year anyway) and opportunity zones, 2018 felt a bit like a redux of 2017. Overall, the industry was incredibly strong. Natural disasters ravaged the coasts. Rising construction costs caused pain for development. WeWork was all over the place. There was a crazy robot story.

But all the same, what a year it was. So take a break from worrying about when it is all going to fall apart, and look back at the trends and deals that defined commercial real estate in 2018.

— Catie Dixon, Managing Editor

RSK: This is good!

Best Of Bisnow 2018: The Year`s 20 Most-Clicked Articles

There was more to 2018 than Amazon ... sort of.

A big chunk of Bisnow`s most-clicked stories of 2018 were related to HQ2, but our readers were also particularly interested in open offices, housing affordability, Chick-fil-A and lawsuits. Check out the 20 stories that most resonated with Bisnow readers this year.

20) Cushman & Wakefield Reportedly Fired Peter Hennessy Over Angry Email He Wrote To Regional CEO

19) Fired Colliers Broker Says Mattress Firm Execs `Weaponized` Real Estate, Encouraged Insider Deals

18) Hotels And Retailers Hit Hard By California Housing Crisis` Ripple Effect

17) CoStar Starts Going After Password-Sharing Users In Latest Legal Blitz

16) Fed Up With Vacant Storefronts, Residents Force Cities To Punish Retail Landlords

15) Former CBRE Executive Accused Of Stealing Trade Secrets To Start Competing Firm

14) Things To Know About The New Opportunity Zone Guidelines

13) 10 Markets That Will Be Flooded With New Apartment Supply In 2018

12) Middle-Class Misery: Housing Crisis Hitting Cities, Working Americans Harder Than Ever Before

11) REPORT: Amazon Is Splitting HQ2 Between 2 East Coast Cities

10) Bay Area Real Estate Leaders Among 5 Killed In Santa Ana Plane Crash

9) Cushman & Wakefield Embroiled In Two Lawsuits Involving Former High-Ranking Execs

8) What Happens When A Whole Foods Closes? A D.C. Neighborhood Is Painfully Finding Out

7) `Everybody Wants Chick-fil-A`: Why The Chicken Chain Is Dominating Fast Food

6) Amazon Job Posting In D.C. A Potential HQ2 Signal

5) Final Verdict: Workers Hate Open Offices And They Reduce Productivity

4) Starwood CEO Barry Sternlicht: `The Endgame For Amazon Is To Wipe Out Main Streets Of America`

3) LOIS WEISS: The HQ2 Search Is A Sham. Jeff Bezos Already Knows The Winner.

2) The Real Estate Rankings Of Amazon’s 19 U.S. HQ2 Finalists

1) JLL Managing Director Loses Job After Arrest For Assault, Burglary

See Also: Editors` Choice: The Very Best Bisnow Stories Of 2018

RSK: Although not all of these would be in my most clicked on articles of 2018 it is worth the read.

Ranking QOZs: How State And Local Officials Can Make Their Opportunity Zones More Attractive To Developers

It goes without saying that not all opportunity zones are created equal or present the same investment opportunities.

As the Qualified Opportunity Zone tax program gains national attention from investors looking to deploy billions in capital gains into those areas, sources tell Bisnow the designated areas stand to benefit greatly from opportunity zone-friendly policies enacted at the federal, state and municipal level to further lure investment where it is most needed...

...Full Story HereRSK: Yes, there are trillions of capital gains to be deferred into OZ`s but one still needs to make sure the investment stands on its own.

Can average investors take advantage of a new real estate development tax break?

There`s a lot of talk about Opportunity Zones. Can anyone invest in them?

RSK: Heed the line that says "Just because you could get a significant tax break from an opportunity zone fund does not mean that it is a good investment."

Opportunity Zones, Marijuana-Related Properties and Retail Assets Among Best CRE Bets for HNW Investors in 2019

As high-net-worth (HNW) investors zone in on commercial real estate opportunities for 2019, Opportunity Zones, multifamily, marijuana, retail and industrial are emerging as some of the key areas to watch.

Real estate investments made next year by HNW investors should be weighed against rising interest rates and the prolonged economic expansion, according to Doug Brien, co-founder and CEO of Oakland, Calif.-based Mynd Property Management, which specializes in multifamily assets.

“For deals to make sense, investors will need to make sure cap rates remain high enough to balance out rising interest rates,” Brien says. “In my opinion, a long-time horizon should be incorporated into any investor’s strategy if they’re acquiring properties at such a late stage in this rising interest rate environment.”...

...Full Story HereRSK: I guess opening a retail weed shop in an opportunity zone is a can`t miss eh?

Opportunity Zones PDF

This document contains proposed regulations under section 1400Z-2 of the Code that amend the Income Tax Regulations (26 CFR Part 1). Section 13823 of the Tax Cuts and Jobs Act, Pub. L. No. 115-97, 131 Stat. 2054, 2184 (2017) (TCJA), amended the Code to add sections 1400Z-1 and 1400Z-2. Section 1400Z-1 provides procedural rules for designating qualified opportunity zones and related definitions. Section 1400Z-2 allows a taxpayer to elect to defer certain gains to the extent that corresponding amounts are timely invested in a QOF.

This document contains proposed regulations under section 1400Z-2 of the Code that amend the Income Tax Regulations (26 CFR Part 1). Section 13823 of the Tax Cuts and Jobs Act, Pub. L. No. 115-97, 131 Stat. 2054, 2184 (2017) (TCJA), amended the Code to add sections 1400Z-1 and 1400Z-2. Section 1400Z-1 provides procedural rules for designating qualified opportunity zones and related definitions. Section 1400Z-2 allows a taxpayer to elect to defer certain gains to the extent that corresponding amounts are timely invested in a QOF....Full Story Here

RSK: The government`s viewpoint on Opportunity Zones rules and regs.

From Gentrification To Lack Of Guidance, Investors Express Concerns With Opportunity Zone Program

Commercial real estate owners, developers, brokers and investment managers have a variety of concerns about the new Opportunity Zone program that gives a tax break to investors who invest through an opportunity fund into a designated opportunity zone. More than 200 of them shared those concerns in Bisnow`s recent survey about the program.

One survey participant called the program “gentrification on steroids.”

Another respondent said the nuances of the program — even with a new round of guidance from the U.S. Department of the Treasury — are still confusing and may turn off investors...

...Full Story HereRSK: The National look at Opportunity Zones....in other words, it is still in its infancy and not much guidance out there at the moment.

Breathing new life into Madison’s most distressed areas

Private investment into economically disadvantaged “Opportunity Zones” could be the key to new growth in Greater Madison.

Thanks to a new economic development tool created under the 2017 Tax Cuts and Jobs Act, Greater Madison could soon see some changes to some of the region’s most economically challenged areas.

The Opportunity Zones program is designed to spur private investment in distressed communities by allowing private investment through tax incentives that are designed to accelerate economic growth and job creation.

In March 2018, 120 areas of Wisconsin were deemed eligible for the program based in part on the number of low-income households in each area, including 11 in Dane County.RSK: Great article by In Business Mag on this subject...definitely worth the read.

10 Must Reads for the CRE Industry

- Amazon Revisits Some Cities as HQ2 Decision Loom

- Where Is It Cheaper To Rent Than To Buy? 16 U.S. Cities Make The Cut

- New ‘Opportunity Zone’ Tax-Break Rules Offer Flexibility to Developers

- Sears’s Edward Lampert Was a Wizard. Now He’s Coming to Terms With Failure

- Trump Organization Sues Man Who Died in Trump Tower Fire

- Among Amazon HQ2 Watchers, Northern Virginia Checks the Most Boxes

- Six Skills Real Estate Investors And Developers Need To Develop

- GWL Acquiring Guggenheim Real Estate

- Mark Lapidus Out at WeWork Amid Real Estate Leadership Shakeup

- Developer to Expand East Side Biotech Campus

Investors Lining Up To Pour Billions Into Opportunity Zones

The federal Opportunity Zones

program has drawn interest from investors around the country, and

policy experts and fund managers expect a flood of capital to flow into

the space as soon as the regulations are finalized.

The federal Opportunity Zones

program has drawn interest from investors around the country, and

policy experts and fund managers expect a flood of capital to flow into

the space as soon as the regulations are finalized. The program, part of the Tax Cuts and Jobs Act President Donald Trump

signed into law in December, gives large tax breaks to investors who

place capital gains into funds that invest in opportunity zones, a set

of largely low-income areas across the country. Local governments nominated their

opportunity zone census tracts in April, and in recent months, several

funds have been set up specifically targeting opportunity zones...

RSK: Didn`t think it would take this long for the big boys to get involved with OPZ`s.

An Increasing Number of New Real Estate Funds Target Opportunity Zones

The Opportunity Zone legislation has already unleashed considerable activity, with real estate companies starting to establish new funds.

The basic premise behind the Opportunity Zones initiative was to offer incentives in the form of deferred and reduced taxes on capital gains to attract private capital for investment in low-income urban, suburban and rural areas of the country. “The simple thought was that if capital was invested in those zones, it would have an appreciable and beneficial effect on those communities,” says John W. Gahan III, an attorney in the real estate department at Sullivan & Worcester in Boston.

What is stirring excitement among both sponsors and investors is that, unlike 1031 tax deferred exchanges, this tax incentive is not just for “like-kind” assets. It allows investors who are selling a variety of assets, such as stocks, art or a business, to reinvest capital gains in Opportunity Zone funds. Some industry estimates put the value of total unrealized gains in the U.S. in the trillions. So, even if a fraction of those dollars finds their way into Opportunity Zone property funds, it has the potential to create a sizable new sector within the real estate investment market....

RSK: Another look at OPZ`s

Opportunity Zones May Spur Economic Growth Through Investor Tax Incentives

The Tax Cuts and Jobs Act of 2017 (TCJA) includes a new tax incentive designed to steer long-term capital investments into economically distressed communities. Investments in these areas, called Opportunity Zones, are eligible for the temporary deferral and potential exclusion of capital gains.

Tax benefits of investing in an Opportunity Zone

The TCJA authorizes each state to nominate up to 25 percent of its low-income communities as qualified Opportunity Zones. The final list of designated census tracts was released by the U.S. Department of Treasury on June 14, 2018.

Temporary deferral of gain...

Permanent exclusion of gain...

...Full Story HereRSK: Thanks to my partner Jim Anderson for the heads up on this none. Many of you have asked about OPZ`s and this is a great outline for it and how it works tax wise.